#12: A Startup Case Study: Chegg

Product strategy tools and frameworks applied to a textbook rental and education startup that now has a $10B market cap.

In 2010, I joined Chegg as Chief Product Officer. The company was founded in 2001 as “Craigslist for college students” but didn’t get traction until it launched textbook rental in 2008. By the end of my first year at Chegg, we generated $150M in revenue.

The GLEe Model

Here’s how I applied the GLEe model to Chegg in 2010:

Chegg Product Vision

- Get Big on Textbooks

- Lead eTextbooks

- Expand into other student services (jobs, internships, etc.)

It was clear that we could get big on textbook rental. Our service provided overwhelming value to students who could rent a textbook for $50 instead of buying a new book for $200. One clear sign of our ability to delight college students: our Net Promoter Score quickly improved from fifty to the high seventies.

Similar to Netflix, I thought Chegg would transition from physical delivery to digital services in 3–5 years, but I was wrong. There are three reasons the transition to eTextbooks still hasn’t happened:

- While I expected students to be early adopters, they were the opposite. Students had a nostalgic relationship with physical books. They spoke longingly about sitting on their parent’s laps as their parents read books to them, and had little interest in eTextbooks.

- Physical books offered advantages students valued that eTextbooks couldn’t match, most noticeably the ability to highlight text using a marker.

- Publishers insisted on pricing eTextbooks close to the price of a new physical textbook. They had no interest in disrupting their highly profitable paper textbook business.

Like most things involving consumer science, the above insights seem relatively obvious today, but the discovery process was long.

As our textbook rental business grew, we set our sights on a new area to lead: homework help. We began by providing step-by-step solutions to all the answers in textbooks. Later, we expanded into other homework help areas — writing help, tutoring, flashcards — to create a monthly subscription service called “Chegg Study.” Today, nearly half of Chegg’s revenues come from its digital services.

So in 2012, when it became clear that eTextbooks would not be a significant part of our business, we amended the “GLEe” model:

- Get Big on textbook rental.

- Lead homework help.

- Expand into other student services.

Chegg is still in the early days of its broader “student services” phase, but they’ll get there. They’re now a public company approaching $400 million in revenue and have a market cap of $10 billion.

The DHM Model

Here are the ideas we explored to delight customers, build hard to copy advantage, and generate margin:

Delight

- Provide overwhelming value through low-price, textbook rentals.

- Deliver fast access to textbooks via a digital “Read While You Wait” eTextbook feature.

- Offer a 21-day return policy in case a student drops a class or the professor doesn’t use the textbook.

- Provide step-by-step solutions to all the questions in the back of textbooks.

- Set up kiosks in campus bookstores to make it easy to rent textbooks.

- Enable students to buy and sell class notes.

Hard to copy advantage

- Create a “student graph.” We built a dataset of all courses on each campus. It included all the textbooks and content that were part of the course.

- Develop unique, personalization technology. We built this capability using the student graph data, above.

- Achieve economies of scale through high-volume, used textbook purchases.

- Build a viral brand, spread campus-wide through large, highly visible, orange boxes.

- Create a network effect through a “homework help platform” where tutors around the world provide answers on Chegg’s platform.

Margin-enhancing

- Execute ongoing price tests for textbook rentals, precisely determining the balancing act between volume and margin.

- Experiment with free v. paid shipping.

- Launch an advertising/sponsorship business via free items in each box, as well as on-site banners and sponsored areas/services.

- Explore eTextbooks and the high-margin digital services we hoped they would provide.

Bringing D, H, & M together to form high-level strategies

In sorting through the “DHM” ideas and experiments above, we teased out the following product strategies.

- Student graph

- Personalization

- Social (a Facebook-style newsfeed based on student graph data)

- Price & selection

- High-margin, digital services

- Build brand, awareness, and trial

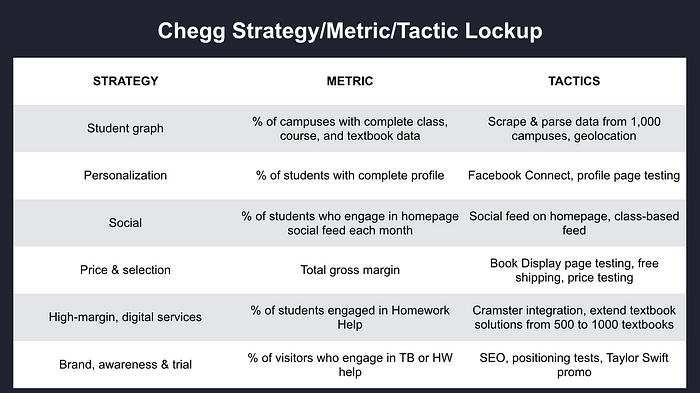

The Strategy, Metric, Tactic Lockup

Below is the lockup for Chegg, circa 2011:

The GEM model

When I joined Chegg, we debated the prioritization of growth, engagement, and monetization. Dan Rosensweig, our CEO, was confident in our ability to raise capital and prioritized “GEM” as follows:

- Growth, measured by year-over-year growth in student accounts and revenues.

- Engagement, measured by six-month textbook retention, Net Promoter Score, and, later, homework help monthly retention.

- Monetization, measured by profit, cash flow, and unit economics.

Our CFO, Greg, was more concerned about our ability to demonstrate a working textbook rental business model. At the time, we took it on faith that we could buy a used textbook for $50, then rent it three times over three years to deliver profitable business. Unfortunately, it would take three years to prove the model, and we couldn’t simply press the pause button — the job of a startup is to grow fast.

Dan and Greg’s differing opinions created lots of tension. Eventually, there was a bit of a “cage match,” and they aligned against the following forced rank:

- Growth

- Engagement

- Monetization

Dan’s confidence in his ability to raise money to fund growth won out over Greg’s desire to slow things down to prove our unit economics. There is no right answer — this is a classic, “you’ll never know the road not taken” situation. But we did manage to raise multiple rounds of funding, to prove the business model, and to grow 25% year-over-year. In late 2013 we took the company public.

The Rolling 4-Quarter Product Roadmap

Below I have outlined the product roadmap. As always, I reinforced that next quarter’s projects would happen on a timely basis but downplayed our ability to deliver projects in subsequent quarters. I reinforced that there would be so much learning in the next quarter that plans would likely change. Nevertheless, our four-quarter product plan told a story of how our swimlanes fit together and how the strategies would come to life, over time.

As always, the roadmap does not include all projects. I did not detail non-customer-facing projects (like the financial systems required to go public). The roadmap provided a relatively high-level view that demonstrated how the product strategies might play out over time.

The last essay in this product strategy series follows. I have brought all the exercises together into one article so you can take a step by step approach to form your product strategy. I have also provided Google Slides so you can “fill in the blanks” to build a SWAG — a Stupid Wild-Ass Guess — of your product strategy.

Final Essay, #13: Step by Step Exercises to Build Your Product Strategy

If you choose not to go on to build a prototype product strategy, please take a moment to give me feedback on this 12-part essay. Your feedback is incredibly helpful to me:

Click here to give feedback — it only takes one minute!

Many thanks,

Gib

Gibson Biddle

PS. Many thanks to Filip Kaliszan, Chuck Geiger, Ciaran Doyle, and Brent Tworetzky for editing help.

PS. NEW! Check out my cohort-based “Product Strategy Workshop” on Maven.

PPS. Here’s an index of all the articles in this series:

- Intro: How to Define Your Product Strategy

- #1 “The DHM Model”

- #2 “From DHM to Product Strategy”

- #3 “The Strategy/Metric/Tactic Lock-up”

- #4 “Proxy Metrics”

- #5 “Working Bottom-up”

- #6 “A Product Strategy for Each Swimlane”

- #7 “The Product Roadmap”

- #8 “The GLEe Model”

- #9 “The GEM Model”

- #10 “How to Run A Quarterly Product Strategy Meeting”

- #11 “A Case Study: Netflix 2020”

- #12 “A Startup Case Study: Chegg”

- #13 “TLDR: Summary of the Product Strategy Frameworks”

- Click here to purchase my self-paced Product Strategy Workshop on Teachable for $200 off the regular $699 price. The course includes recorded talks, PDFs, and my essays along with pre-formatted Google Slides so you can complete your product strategy on your own. You can also “try before you buy” — the first two modules are free.